How to form an LLC in Louisiana? An LLC, or limited liability company, is a business entity that is separate from its owners. LLCs are popular because they offer personal liability protection and tax benefits.

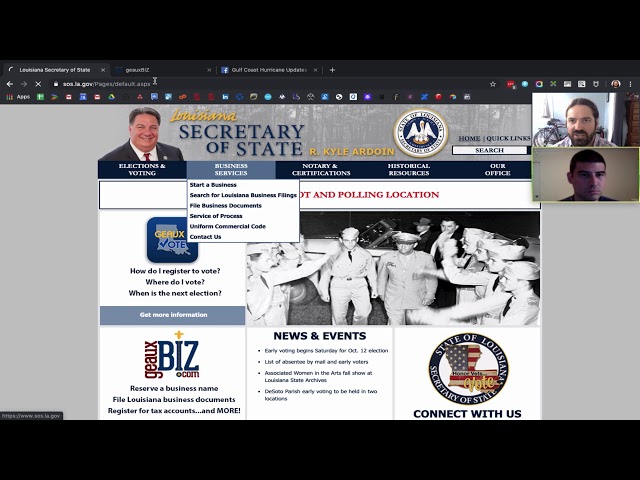

Checkout this video:

Overview

Introduction

An LLC, or limited liability company, is a type of business structure that provides limited personal liability protection to its owners. LLCs are popular among small business owners because they are relatively easy and inexpensive to form and maintain. In addition, LLCs offer flexibility in how they can be managed and taxed.

If you are thinking about starting an LLC in Louisiana, here is what you need to know.

1. Select a business name for your LLC. The name must include the words “Limited Liability Company,” “L.L.C.,” or “LLC.” It may not include the words “corporation,” “incorporated,” or any abbreviations thereof.

2. File Articles of Organization with the Louisiana Secretary of State’s office. The Articles must include the LLC’sName and Address, Registered Agent’s Name and Address, Purpose, Duration, and Signature of the Organizer. You can file online, by mail, or in person. The filing fee is $60.

3. Create an Operating Agreement for your LLC. This is an internal document that outlines the ownership and management structure of your LLC. It is not required by Louisiana law, but it is a good idea to have one in place to avoid future disagreements among members.

4. Obtain any necessary licenses and permits required to operate your business in Louisiana. Depending on your type of business, you may need to apply for a state professional license or permit from the Louisiana Department of Health and Hospitals or other state agency . You should also check with your local parish or city government to see if there are any local licenses or permits required .

5 . Start operating your business!

The Process of Forming an LLC in Louisiana

Before you form an LLC in Louisiana, you need to choose a business name and register it with the state. You will also need to appoint a registered agent and file the Articles of Organization with the Louisiana Secretary of State. Lastly, you will need to create an operating agreement. Once you have done all of this, you will be ready to form your LLC.

Choose a name for your LLC

Your LLC’s name must include the phrase “Limited Liability Company” or the designation “L.L.C.” or “LLC.” It may not include language that would make it seem like your LLC is organized for a purpose other than conducting lawful business, and it may not be the same as the name of a corporation or LLC already registered with the state.

You can check to see if your desired LLC name is available by searching the business entity database on the Louisiana Secretary of State website. If your first choice is unavailable, you can choose an alternative name and submit a Name Reservation Request form along with a $60 filing fee.

File a Certificate of Formation

To form an LLC in Louisiana, you must file a Certificate of Formation with the Louisiana Secretary of State. The Certificate of Formation must include the following information:

· The LLC’s name and address

· The LLC’s purpose

· The name and address of the LLC’s registered agent

· The names and addresses of the LLC’s organizers

· The effective date of the LLC’s formation, if different from the date of filing

· A statement that the LLC will be governed by the Louisiana Limited Liability Company Act

· A statement that the Louisiana Secretary of State has no right to approve or disapprove of the matters stated in the Certificate of Formation

You can file your Certificate of Formation online, by mail, or in person. The filing fee is $60.

Appoint a registered agent

To form an LLC in Louisiana, you must appoint a registered agent. A registered agent is an individual or business that agrees to accept service of process and other legal documents on behalf of your LLC. A registered agent must have a physical street address in Louisiana and be available during regular business hours. You can name yourself as the registered agent, but we recommend against it. If you are named as the registered agent and you are served with legal papers, they will be delivered to your home or business address, which may not be ideal.

Create an operating agreement

All LLCs in Louisiana are required to have an operating agreement. This is a legally binding document that outlines the ownership and operation of the LLC. The operating agreement should include:

-The name and address of the LLC

-The names and addresses of the members

-The LLC’s purpose

-How the LLC will be managed (by member or manager)

-How profits and losses will be distributed among the members

-How the LLC can be dissolved

The operating agreement does not have to be filed with the state, but it is a good idea to keep it on file with your other business documents.

File annual reports

All LLCs organized in Louisiana are required to file an annual report with the Louisiana Secretary of State. The purpose of the report is to update the state on the LLC’s current contact information and to confirm that the LLC is still in good standing. The report is due by May 1st of each year, and there is a $50 filing fee.

To file your annual report, you will need to complete and submit a “Louisiana Annual Report for Limited Liability Companies” form. This form can be found on the Secretary of State’s website. Once you have completed the form, you can mail it to the address listed on the website or you can submit it online.

If you choose to submit your report online, you will need to create an account with SOPAC (the Secretary of State’s Online Portal for Businesses). Once you have created an account, you will be able to login and submit your annual report.

The Benefits of Forming an LLC in Louisiana

If you’re considering starting a business in Louisiana, you may want to form an LLC. An LLC is a limited liability company, and it offers several advantages over other business structures. For one, an LLC can help protect your personal assets from being seized if your business is sued. Additionally, an LLC can make it easier to raise money from investors and to get loans from lenders. Finally, an LLC can make it simpler to manage your business. Let’s take a closer look at each of these benefits.

Limited liability protection

One of the primary benefits of forming an LLC in Louisiana is the limited liability protection that it offers to its owners. Unlike sole proprietorships and partnerships, an LLC shields its owners from personal liability for business debts and obligations. This means that if your LLC is sued or incurs debts, your personal assets will not be at risk.

Tax benefits

When you form an LLC in Louisiana, you automatically gain what is called pass-through taxation. This means that your LLC does not have to pay corporate taxes on its profits. Instead, any money the LLC earns is “passed through” to the individual members of the LLC and taxed at their personal tax rate. This can save you a significant amount of money in taxes every year.

Flexible management structure

An LLC in Louisiana can have any management structure that its members agree to. LLC members can manage the business themselves, appoint managers to run the business or have a mix of both. This flexibility gives LLCs the advantage of being able to adapt their management structure to fit the changing needs of the business.

LLCs also have the option of choosing between two different types of management structures: member-managed and manager-managed.

A member-managed LLC is one where all of the LLC members take an active role in managing and running the business. This is the most common type of LLC management structure.

A manager-managed LLC is one where a group of LLC members, known as managers, are responsible for managing and running the business. The managers are typically chosen by the LLC members and can be either LLC members or non-members.

Conclusion

Assuming you have gathered all of the required information and have made all of the necessary decisions, you are now ready to form your LLC. The first step is to file your Articles of Organization with the Louisiana Secretary of State. The filing fee is $100. You will also need to prepare and file your Operating Agreement. This document does not need to be filed with the state, but it is important to have in place as it will govern the rules and regulations by which your LLC will operate.

Once your Articles of Organization have been accepted, you will need to obtain an Employer Identification Number (EIN) from the IRS. You can do this online, by mail, or by fax. Once you have obtained your EIN, you will need to open a business bank account in the name of your LLC.

Now that you have formed your LLC, you should consult with an experienced business attorney to discuss ongoing compliance requirements and to assist with any additional legal needs you may have.

“Internet expert. Amateur food trailblazer. Freelance tv scholar. Twitter advocate.”