When it comes to business entities, there are LLCs and there are corporations. So, what’s the difference?

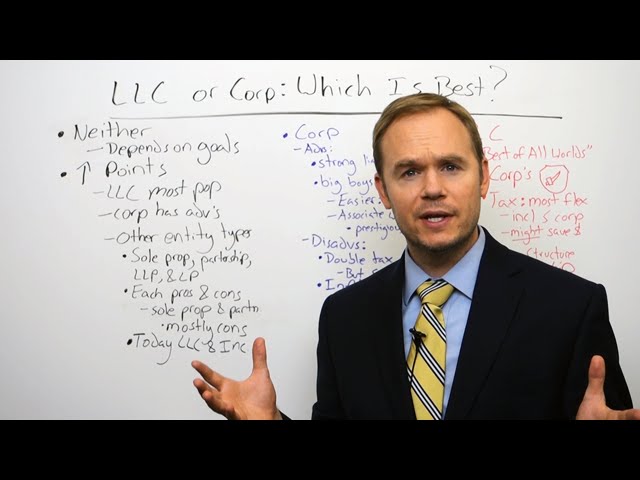

Checkout this video:

Overview

Introduction

There are many different types of business structures available to choose from when starting a business. Two of the most common business structures are limited liability companies (LLCs) and corporations. Both LLCs and corporations offer liability protection to their owners, but there are some key differences between the two business structures.

Owners of an LLC are called members. LLCs can have one member or multiple members. The members of an LLC can be individuals, trusts, estates, other LLCs, or corporations. Unlike shareholders in a corporation, the members of an LLC are not protected from personal liability for the debts and obligations of the LLC.

Corporations are owned by shareholders. Shareholders elect a board of directors to manage the corporation. The board of directors then appoints officers to run the day-to-day operations of the corporation. Officers and directors of a corporation are protected from personal liability for the debts and obligations of the corporation.

LLCs are less formal than corporations and have fewer compliance requirements. For example, corporations are required to hold annual meetings and keep minutes of those meetings, while there is no such requirement for LLCs. LLCs also do not have to issue stock like corporations do.

One key advantage that corporations have over LLCs is that they can raise capital more easily by selling shares of stock to investors. On the other hand, because LLCs are not required to issue stock, they may be seen as more attractive to potential investors than corporations.

Deciding which business structure is right for your new business is a critical decision that should not be made lightly. Be sure to consult with an experienced attorney or accountant before making your final decision.

What is an LLC?

An LLC, or limited liability company, is a type of business structure that offers its owners limited liability protection. LLCs are popular among small businesses because they are relatively easy to set up and maintain. There are also fewer formalities and regulations associated with LLCs than there are with other business structures, such as corporations.

There are a few things to keep in mind if you’re thinking about forming an LLC:

-LLCs can be formed by one or more individuals (known as members).

-LLCs can be created for any lawful business purpose.

-LLCs offer their members limited liability protection. This means that the members’ personal assets are protected from debts and liabilities incurred by the LLC.

Unlike corporations, which must have a board of directors and hold annual shareholder meetings, LLCs are not required to have either. However, LLCs can choose to adopt these corporate governance practices if they wish.

What is a Corporation?

A corporation is a legal entity created by a state to engage in business activities, generate profit, and limit the liability of its owners. A corporation is owned by shareholders and overseen by a board of directors. The officers of the corporation manage the day-to-day operations. Corporations can be small, privately held businesses or large, publicly traded companies.

The Difference Between an LLC and a Corporation

Deciding to form a limited liability company (LLC) or a corporation is an important first step for any business. Each type of entity has its own distinct advantages and disadvantages, so it’s important to understand the key differences before making a decision.

An LLC is a business structure that can combine the best aspects of a sole proprietorship, partnership, and corporation. LLCs are relatively easy and inexpensive to form, and they offer personal liability protection for their owners. corporations, on the other hand, tend to be more complex and expensive to form. They also offer different tax treatment and different benefits and drawbacks when it comes to personal liability protection.

Here are some key points to consider when deciding whether an LLC or a corporation is right for your business:

-Formation: LLCs are relatively easy and inexpensive to form, while corporations tend to be more complex and expensive.

-Personal Liability: LLCs offer personal liability protection for their owners, while corporations do not.

-Tax Treatment: LLCs and corporations are taxed differently, so it’s important to understand the implications before making a decision.

-Size: Corporations tend to be larger businesses with more employees than LLCs.

Conclusion

The bottom line is that LLCs offer a lot of flexibility and are often less expensive to set up and maintain than corporations. However, corporations offer certain advantages, such as the ability to raise capital more easily and the potential for tax benefits. Ultimately, the bestbusiness structure for your company will depend on your specific needs and goals.

“Extreme travel enthusiast. Thinker. Total food expert. Devoted bacon buff.”